Scott Gottlieb, the man President Trump has appointed to head the FDA, wants to loosen its regulation, to permit more innovation. This is a step in the right direction. But it’s one step in a journey of 100 miles. And no one dreams of making that journey.

The more consistent pro-capitalists recognize that the FDA greatly impedes medical innovation, because of its incredibly lengthy, expensive, and onerous requirements before any medical innovation can be released to the public. That’s the easy part.

The deeper issue is individual rights. And this issue is understood only by a small minority within the preceding small group. The individual has a right to put any substance into his body at any time for any reason. He has a right to buy any such substance from any willing seller under whatever terms they each consider advantageous to themselves.

The government has no legitimate role in medicine. None. Not in regard to what people take into their bodies, not in regard to who sells what for people to take into their bodies (absent proven fraud), not in regard to who calls himself a doctor, or a pharmacist, or a nurse, or an anesthesiologist, or a physical therapist, a psychiatrist, a dentist, a surgeon—anything.

(Re fraud: we must be constantly on guard against preventive law: government cannot demand that anyone prove that he is not engaged in fraud. The government cannot interfere with private activity unless there’s “probable cause” of a rights violation—which, in the case of fraud, means evidence of a specific fraud involving specific representations made in specific media on a specific date(s). The government cannot treat doctors or medical firms as guilty until proven innocent.)

Many people understand that the government has no right to stop people from committing suicide. If that’s so, how can they have a right to stop them from knowingly doing something that some bureaucratic panel believes risks the individual’s death?

The right to suicide is an expression of the right to life. Just as the right to your property includes the right to discard or destroy that property when it is no longer valuable to you, so the right to your life includes the right to discard or destroy your life when it is no longer valuable to you.

Imagine that the government required the sellers of pencils to go before a panel and show studies to prove that their latest model won’t damage your papers, and that it makes marks “effectively.” And imagine the same principle applying to everything sold that affects your property—which means just about everything sold.

Couldn’t you, in that case, say to the government: “I want to buy and use this pencil, and I don’t care if it ‘harms’ my paper; it’s my paper; I can throw it in the trash or burn it in the fireplace if I want. I decide what’s good for my paper, not you”?

The same thing is true, but more so, in regard to your ownership of your body and your life.

(“Ownership” here is a metaphor: your life is the source of all your rights, including rights of ownership, so you can’t literally have property rights to the source of your property rights: your valuing of your own life.)

The premise of the FDA is: you are government property. That’s what would have to be true for the government to have legitimate authority over how you treat yourself.

The other pillar supporting the FDA is: altruism. The rational individuals, who would not swallow the snake-oil cure-all, have to be stopped to protect the irrational. That means: you cannot be allowed to buy drugs without a prescription because Looney Louie would harm himself if everyone were free of this prescription law.

Notice, what’s at stake here is rationality, not intelligence or knowledgeableness. A rational person knows his intellectual limitations and seeks the advice of the more intelligent and knowledgeable. (And private certification would be a crucial aid here.)

But the premise of the FDA is that the person needing to be protected from himself is the one who would not seek a doctor’s or scientist’s advice but would lurch into action irrationally.

And since “rational vs. irrational” is the same alternative as “moral vs. immoral,” what the FDA is set up to accomplish is nothing less than the sacrifice of virtue to vice. It stops the rational, conscientious, moral man from acting on his judgment—for the sake of protecting the irrational, out-of-focus, immoral man from the consequences of his chosen state.

Nothing could be more evil.

I opened this post by distinguishing between two levels of opposition by pro-capitalists who are against the FDA. The first level is that of people who will tell you that the FDA is a good and needed agency but there’s a problem with some of the Agency’s decisions. These people think that the FDA is just part of civilized existence.

I pointed out a deeper level: individual rights and how the FDA violates them.

Now I want to outline the third, deepest level of understanding: the integration of the moral and the practical.

The immorality of the FDA lies in its forbidding individual judgment. The FDA exists solely to arrest anyone who acts without permission. The FDA does not exist to provide expert opinion on medical substances and practices: private, non-governmental voluntary certification does that. What the FDA adds is the power to arrest and imprison those who dare to disagree with its medical opinions.

And that takes us to the deepest point. The necessary result of throttling private judgments is: mass death.

I don’t mean just the deaths of those millions of diseased individuals who cannot get the life-saving drugs. Much worse is the fact that outlawing private judgment means a drastically shorter life-span for every one of us.

Let me try to concretize the extent of this tragedy. If America had continued through the 20th century the nearly laissez-faire system of the 19th, it’s a good bet that Ayn Rand would be alive today at age 113, and would still be in good health.

It is quite likely that, had we continued with almost-full capitalism, then the Millennials would have a lifespan of 200 years, or longer. The reason that sounds like fantasy is that statism has hamstrung America for so long that we have unconsciously lowered our expectations of progress.

Let me make my vision more plausible to you. Assume—just for the sake of argument—that the nation survives in more or less its present political condition for another two centuries. Do you have much doubt that in 2218, medical progress will have reached the levels I describe?

Probably, the idea that people born in 2218 would have a 200-year lifespan seems plausible. If so, ask yourself whether, under capitalism, we could have gotten to that point already.

For comparison, consider what happened in the 125 years of capitalism we had from 1796 to 1921: the world was entirely transformed. The average American in that century went from a life hardly different from that of his ancestors going back two thousand years, to a world of trains, electricity, automobiles, movies, phonographs, airplanes, steamships, submarines. And, medically: X-rays, sanitary conditions in hospitals, anesthesia (and the consequent development of surgical techniques), vaccination (discovered by Jenner in 1796), and an extension of the American lifespan from between 30 and 40 to over 60 by 1921.

So why has U.S. life expectancy gone only to 78.7 in the 97 years since it hit 60? Why isn’t life expectancy now over 100? In fact, since knowledge builds on knowledge and wealth builds on wealth, the rate of increase should have been accelerating!

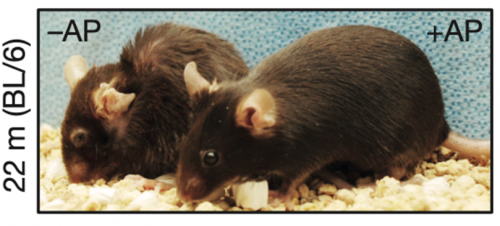

You might think that there’s some inherent limit on the span of a human life. I don’t think there is, and neither do lots of people better informed than I. Especially not when there is the ability to re-program our DNA.

But go ahead and assume that there is an effective upper limit of 100 or 110. Now consider the 20 to 30 years of extended life that even those born today are, on average, not going to see.

What took away that 1/3 of the individual’s life? Government. And more directly than any other arm of the government, the killer is the FDA.

The reason is “that which is not seen”—the progress that was not made is invisible to the public.

The first factor generating the non-improving lifespan is the regulatory hurdles that soak up time and funds. But there’s another, unrecognized factor that dwarfs that one: the absence of mass experimentation.

We should have had a century of thousands of self-chosen medical trials going on simultaneously, with the superior innovations being swiftly adoped.

There would have been and should have been ad hoc experiments on all fronts: people trying out new concoctions, new dosages of medicines, new surgical procedures, implanted devices, chemotherapies, immune-system boosting therapies, genetic repair and splicing in of new designs . . . and more.

There have been, of course, official “studies” done on each innovation in all those areas. But the shocking part is the realization that there could have been hundreds times more experiments—by the parties that decide on their own they want to try out the latest pill.

With the liberation of private self-medication, we would have had Big Data to go by. And we now recognize the immense value of Big Data.

Would it have been difficult to separate out legitimate results from placebo effects? No, not at all, because we’re interested not in mild tweaks (e.g., a slightly better throat lozenger), but in identifying unsuspected radical improvements.

Incremental improvements do have an important role, however. They point the way to more radical change. If you were trying to develop a cure for, say, rheumatoid arthritis, you would have been scouring the nation, or the world, for word on what treaments were working and to what extent. If you learned of a minor improvement associated with taking some drug, that could be the essential item of knowledge that could lead to your making a huge integration that led to a radical improvement.

The mass experimentation I’m talking about is just: a large number of independent, private decisions. lt’s a Darwinian process: the more “mutations” are tried, the better the success rate overall.

When men are liberated to act on their own judgment, the experimentation produces data-rich results. Even the unwise or downright irrational would have accelerated technological progress: you learn things from failure, including about bad and good side-effects. (As to good side-effects: many drugs developed for treating one illness are being found significantly helpful in combatting entirely different maladies.)

In the 1980s when “personal computers” got started, we had that kind of competition in place, and the extinction of laggard firms was continual and widely noted. No Board could have predicted the quick disappearance or exiting from the “microcomputer” field of such hardware and software leaders as: Northstar, Tandy/Radio Shack, Digital Research (CP/M), Magic Pencil, Lotus 1-2-3, PageMaker, Atari, Osborne, Altair, Wordstar, CBasic, Commodore, KayPro, Sinclair, Xerox, and IBM. If a government committee had required a decade of testing of each new computer product, we would still be in the age of the adding machine.

The path to genetic cures and radical life extension begins with the abolition of that Servant of Death: the FDA.

As a significant first step, an enormous amount of good could be achieved by slapping back the huge power grab the Death Agency made in 1962. It was then, under President Kennedy, that the agency vastly expanded its reach by, for the first time, setting itself up as the dictator over not just the safety of drugs but their “efficacy.”

Proving efficacy is much harder, more expensive, and more time-consuming than proving safety. Consider some twists and turns introduced by the efficacy standard. Suppose you offer an alternative to an existing drug that has the same effectiveness—should you be “permitted” to sell it? Suppose it is a little less effective on average, but much more effective with a certain sub-sector of the population? And how much does its purported efficacy depend on the placebo effect—an issue that doesn’t come up in proving safety.

The justification offered for including “efficacy” in the agency’s (death-dealing) mission is that an ineffective drug can divert a person from the drugs and medical treatment that he should be getting. So, if Mindless Marvin is permitted to buy and take an ineffective drug to treat his cancer, he will only later, if ever, turn to legitimate medical treatment—and by then it may be too late.

Yes, that’s true about Marvin, but so what? The horrible assumption is that the rest of us have to die early so that the nation’s contingent of flakes and evaders can escape the consequences of their own choices.

For relief, let’s turn to Galt’s speech.

The political system we will build is contained in a single moral premise: no man may obtain any values from others by resorting to physical force. Every man will stand or fall, live or die by his rational judgment. If he fails to use it and falls, he will be his only victim. If he fears that his judgment is inadequate, he will not be given a gun to improve it. If he chooses to correct his errors in time, he will have the unobstructed example of his betters, for guidance in learning to think; but an end will be put to the infamy of paying with one life for the errors of another.

[My emphasis]